Travel with confidence, knowing you’re protected wherever you go

Travel insurance protects travelers from financial losses and unexpected issues like trip cancellations, medical emergencies, and lost baggage. It provides timely support and reimbursement, ensuring peace of mind and allowing you to enjoy your journey with confidence.

From international adventures to student stays abroad, discover insurance plans tailored to your specific travel needs.

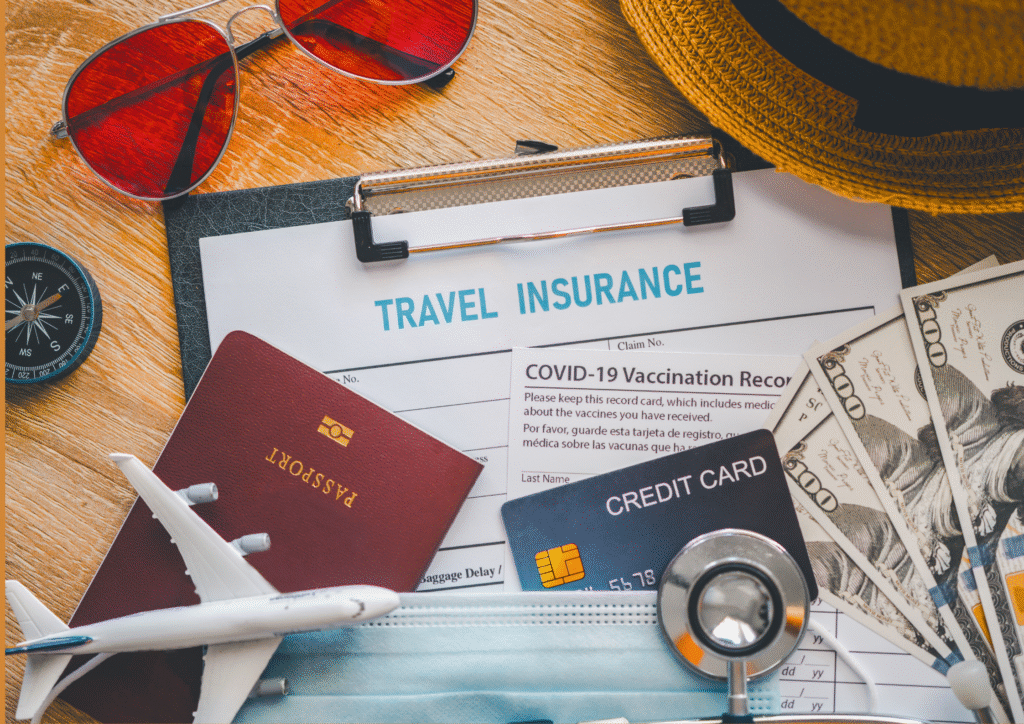

What is travel Insurance

- Travel insurance offers comprehensive financial protection against unforeseen events that may disrupt your travel plans. Designed to cover a wide range of risks, including trip cancellations or interruptions, medical emergencies, baggage loss, and travel delays, it provides essential support and peace of mind throughout your journey. Whether traveling domestically or internationally, securing travel insurance is a prudent measure to safeguard your investment and ensure access to timely assistance when it matters most.

Why do you need travel insurance

Financial Protection Against Travel-Related Losses?

Travel insurance protects you from unexpected financial losses that can occur during your trip. Whether it’s the loss of checked-in baggage, theft of personal belongings, or loss of your passport, travel insurance compensates you for these unforeseen expenses. This helps to reduce the stress and cost burden of replacing lost items or dealing with travel disruptions, giving you greater financial security throughout your journey.

Coverage for Medical Emergencies Abroad?

- While not all travel insurance cover medical emergency most of the insurer cover include this as a standard emergency situations, some may offer basic plans with limited medical benefits or require add-ons to cover pre-existing conditions. Medical treatment abroad can be extremely expensive, and travel insurance reimburses these costs up to a specified limit. Many insurers also provide access to network hospitals with cashless treatment facilities, ensuring you get timely and quality care without the worry of hefty bills immediately.

Protection Against Trip Cancellations and Changes?

Travel plans can be disrupted due to unforeseen circumstances such as illness, natural disasters, or financial issues with travel providers. Travel insurance covers non-refundable trip costs if you need to cancel or cut short your trip due to covered reasons. It also helps reimbursing expenses arising from missed connecting flights or sudden changes to your itinerary, ensuring that disruptions don’t lead to significant financial losses.

Personal Liability Coverage While Traveling?

During your travels, you might inadvertently cause damage to a third party’s property or injure someone. Personal liability coverage in travel insurance protects you by covering the cost of such damages or injuries. This coverage may include legal expenses or compensation claims, providing peace of mind that you are protected from liabilities that could arise while exploring new places.

Types of Travel Insurance

Explore the Different Types of Travel Insurance

Travel insurance claim

- It is essential to familiarize yourself with the claim procedures and documentation for each cover in your policy to ensure a smooth claim process.

- Travel insurance is typically a package policy covering events such as hospitalization, personal accident, loss or damage to baggage, and loss of passport.

- The claim procedure and required documents differ depending on the type of cover; all necessary details are specified in your policy document.

- Insurers usually provide a claim form with the policy; listing required documents and contact information for the claims administrator in the relevant country.

FAQs

Is travel insurance mandatory?

For many countries (like Schengen nations), travel insurance is mandatory for visa approval. For others, it is highly recommended for financial protection.

Are pre-existing medical conditions covered?

Usually not. Most policies exclude claims that arise out of pre-existing medical conditions.

Can I extend my travel insurance policy if my trip gets extended?

Yes, many insurers allow policy extensions if requested before the policy expires. There are limits on maximum days of coverage.

Does travel insurance cover trip delays or rescheduling?

Yes, travel insurance covers costs arising from flight delays or cancellations due to illness, weather, or other disruptions.

How do I make a claim under travel insurance?

Contact the insurer immediately and submit supporting documents (medical bills, police report, proof of delays, etc.) as required for claim approval.

What is the difference between single-trip and multi-trip travel insurance?

Single-trip covers one journey, while multi-trip covers multiple journeys within the policy period, ideal for frequent travellers.